The new IRS withholding calculator and Form W-4 have been out a couple of weeks now. Have you done a paycheck checkup yet?

Who should review their withholding?

Right now, everybody. The upheaval of the new tax reform bill and its roll-out well after the beginning of the tax year means that the IRS is recommending all employees review their withholding now and submit a new Form W-4 to their employers if necessary.

When you should review withholding?

- Right now for the 2018 tax year

- At the beginning of each tax year (your 2018 calculations may not be accurate for 2019 because of the late tax reform rollout)

- If you received a large refund or had a large unexpected balance due on your 2017 tax return

- Within 10 days of a big life event (married, divorced, have a new child or an older child is no longer a dependent, bought or sold a home, etc.)

- Whenever you or your spouse start a new job

- When there are changes to the federal or state tax laws that might affect your tax liability

How to check your withholding

Federal

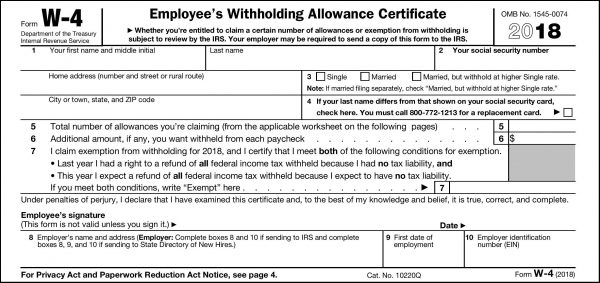

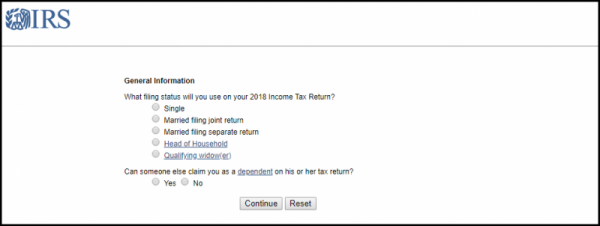

The simplest method to review your federal withholding is to use the IRS Withholding Calculator. This should produce accurate calculations for most taxpayers. To use the calculator you will need your most recent paystubs. If you have already filed your tax return this year, a copy of your Form 1040 for 2017 will be helpful. If you prefer to do the calculations yourself, you can follow the instructions for filling out Form W-4 and the three worksheets that come attached.

For more complex tax situations, such as taxpayers who:

Are subject to the Alternative Minimum Tax

Have long-term capital gains or qualified dividends

Owe self-employment tax

Are dependents with unearned income

Owe certain other taxes

you will need to use the instructions in Publication 505: Tax Withholding and Estimated Tax. You can make an appointment with your tax professional to receive help planning your withholding.

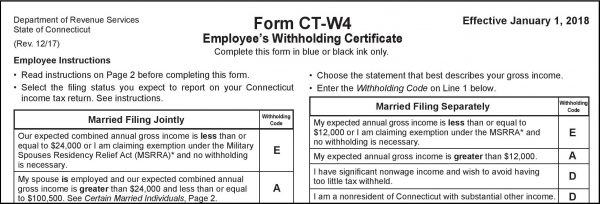

Connecticut

Did you owe Connecticut a lot this year or get a large refund back? Then you should take the time to review your CT Withholdings as well. Unfortunately, the Connecticut Department of Revenue Services does not provide a convenient calculator. If you need to check your CT withholdings you can do so using the CT withholding informational publication and the instructions that come with Form CT-W4 or contact your tax professional for an appointment.

If you have been receiving retirement income from a pension or annuity, there is a newly designed Form CT-W4P for 2018. There is a pension and annuity withholding calculator available. This form should be sent directly to the pension payer if adjustments need to be made.

If you need professional help with your withholding, call our office at 860-216-2195. Appointments for tax planning and withholding review will be scheduled for after April 17, 2018.