Has your side project turned into some extra cash? If you’ve joined the growing gig economy, your new venture brings with it a whole new world of tax implications. As you navigate the challenges of being a new business owner, make sure you’ve got keeping Uncle Sam happy covered.

Make estimated tax payments.

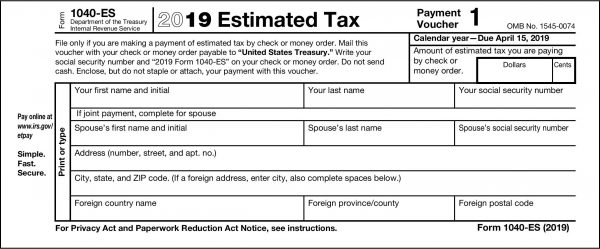

If you expect to owe more than $1000 when your return is filed, you will need to make estimated quarterly payments. You must set aside a portion of your income to make these payments by their due dates. Failure to pay quarterly taxes and at least 90% of your total taxes due may subject you to penalties when you file your tax return. You can use the IRS worksheet to determine your quarterly payments or make an appointment with your accountant.

You will also need to make estimated payments to Connecticut. If you operate your business in other states as well, you may be subject to additional laws. Consult a tax professional to ensure you are fulfilling your obligations.

Be prepared to pay the self-employment tax.

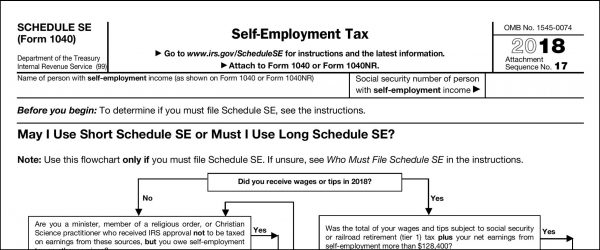

All taxpayers are required to contribute toward Social Security and Medicare at a rate of 15.3%. As a W-2 employee your employer pays for half of this, then withholds the other half from your gross income. As a self-employed person, you are responsible for paying the entire 15.3% on income up to a threshold (for the Social Security withholding portion; Medicare withholding has no upper limit), which is $128,400 for 2018. The good news is this threshold is for income after subtracting legitimate business expenses, and the 7.65% ‘employer half’ of the tax counts as a deductible business expense for federal tax purposes.

If you made more than $400 in self-employment income during the year the 15.3% will need to be set aside and included in your quarterly estimated tax payments, in addition to any income taxes you expect to owe at the state and federal levels.

Keep excellent records.

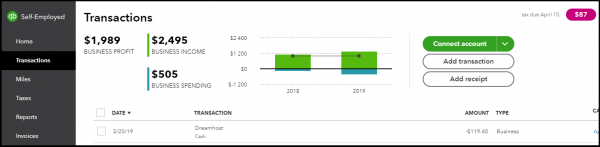

An advantage of being self-employed is the amount of tax-deductible business expenses available. To take full advantage of these deductions, the IRS requires your records to be complete and accurate. You will need to record every expense related to your business, be able to produce receipts and keep careful track of any mileage for business driving. Talk to a tax professional about whether your home office qualifies for a deduction.

You will also need accurate income records. A client is only required to furnish a 1099-MISC if they’ve paid you more than $600 during the year. Third party payment networks (like PayPal, Etsy, etc.) are only required to issue a 1099-K if the gross payments exceed $20,000 and a minimum of 200 transactions. Whether or not a tax form arrives, you will need to report all income on your tax return.

There are numerous software programs and apps available to make record keeping easier. Some include features such as storing receipts digitally and GPS logging business driving, in addition to basic accounting functions.

Don’t neglect your retirement.

If you’ve left the corporate world entirely, you won’t be able to make further contributions to your 401(k). Once you can afford to do so, you may want to roll it over into an IRA and keep saving for your retirement. You can contribute up to $6,000 a year (in 2019; $7,000 if over 50) and may be eligible for a tax deduction on your contributions. Talk to a financial advisor about the best options for you.

If you are new to self-employment, make an appointment with a Bacon & Gendreau professional. We offer bookkeeping and payroll services, preparation of estimated tax vouchers, sales tax filings, business tax return filing, and comprehensive tax planning for independent contractors and small businesses in the West Hartford area.