Looking for some extra deductions? Whether you cleaned out a closet or made your regular tithe to your church, here’s what you need to know about writing off that donation.

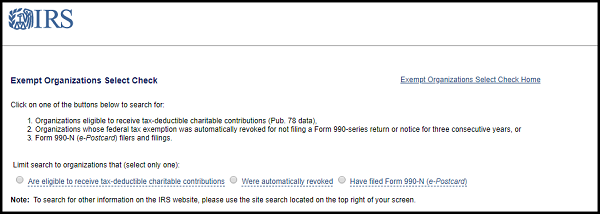

1. Your gift must be to a qualified charity.

The IRS provides an Exempt Organization Select Check tool to help you determine if the organization is a qualified charity for tax purposes. Certain groups who are still qualified charities do not appear in the database, such as religious organizations, government agencies, and groups using a DBA (a “doing business as” alternate name).

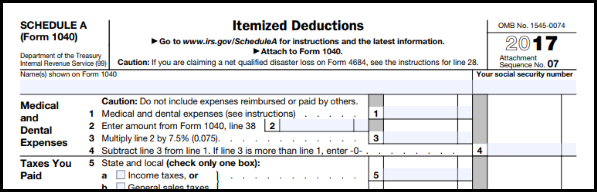

2. You must itemize deductions on your taxes.

Your donation cannot be deducted on top of the standard deduction. Taxpayers who choose to take the standard deduction on their tax returns rather than itemize deductions on Schedule A cannot deduct charitable gifts.

3. You cannot have received a benefit valued at more than the donation.

If you received merchandise, food, event tickets, etc. in exchange for your charitable gift, only the portion greater than the fair market value of the benefit you received in return is deductible.

Did you meet those conditions? You’ll need documentation to go with it.

Cash gifts

Keep a record of all cash gifts. This can be a bank record, such as a cancelled check or account statement listing the name of the charity, a W-2 listing charitable payroll deductions, or a written acknowledgement from the charity. Cash gifts in excess of $250 require the written statement from the charity.

Household goods

Household items such as furniture, housewares, electronics, etc. must be donated in good-used or better condition to be deductible. Grabbing a few snapshots may be useful later. You need to keep a record of the items donated, their fair market value, and their condition. Some larger charities such as Goodwill and the Salvation Army provide standard value lists as a guide. A form for keeping track can be found here.

Donations whose total value is greater than $250 require a written acknowledgement from the charity. High value donations greater than $5,000 (such as antiques, jewelry, and art) require that a qualified appraisal be included with your documentation. If your non-cash gifts total more than $500, you will need to submit Form 8283 with your tax return.

Vehicles and boats

Special rules apply when donating a vehicle or boat. How it is used or sold by the charity determines whether you can deduct the fair market value or only the actual selling price. You should receive a Form 1098-C from the charity within 30 days to give to your tax professional.

Still have questions? Your tax professional can help you plan your charitable giving. Call us to set up a tax planning appointment.