The arrival of an IRS notice in your mailbox can be a terrifying prospect. Even if you never need to assert them, it’s reassuring to know that you have legal rights built into the US tax code. In 2014, the IRS summarized these laws into Publication 1, “The Taxpayer Bill of Rights”. Being aware of your rights can help you advocate for yourself or locate resources that can.

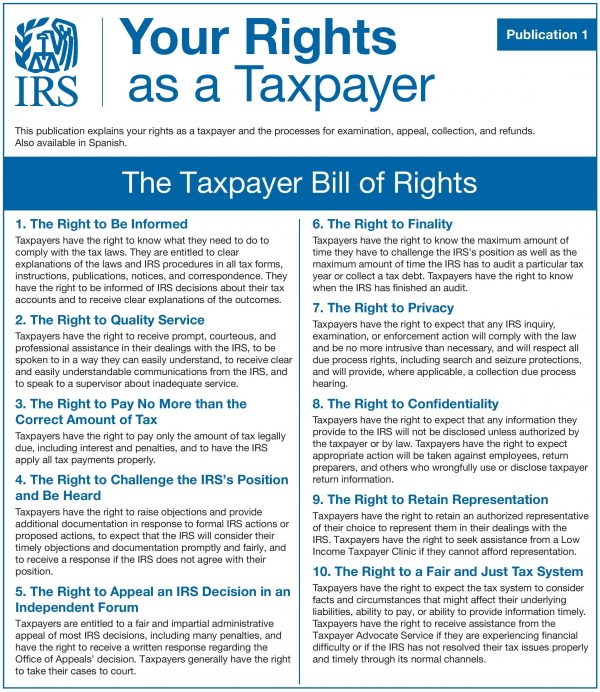

Federal Rights

If you have questions or concerns, the Taxpayer Advocate Service was created to help. They are an independent organization within the IRS created to ensure that every taxpayer is treated fairly and understands their rights. They are not a substitute for personal representation.

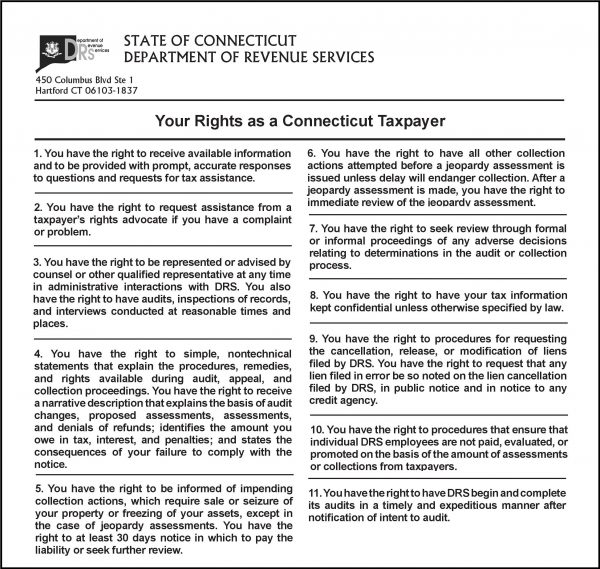

Connecticut Rights

Connecticut General Statutes provide a similar Taxpayer Bill of Rights to ensure that taxpayers’ rights, privacy, and property will be protected while assessing and collecting taxes.

The Connecticut DRS Taxpayer Advocate Office works with taxpayers to ensure fair and consistent application of CT tax law and to resolve issues after the usual channels have been exhausted. They are an escalated level for dispute resolution and are not a substitute for personal representation.

Defend your rights

If you do find yourself being scrutinized by the IRS or the CT DRS you shouldn’t necessarily attempt to go it alone. Our Enrolled Agent services are available should you be audited. Enrolled Agents are the only tax practitioners licensed by the federal government and may represent taxpayers without limitation before the IRS. If you are being audited by the IRS or the CT DRS, call our office to discuss how we can help.