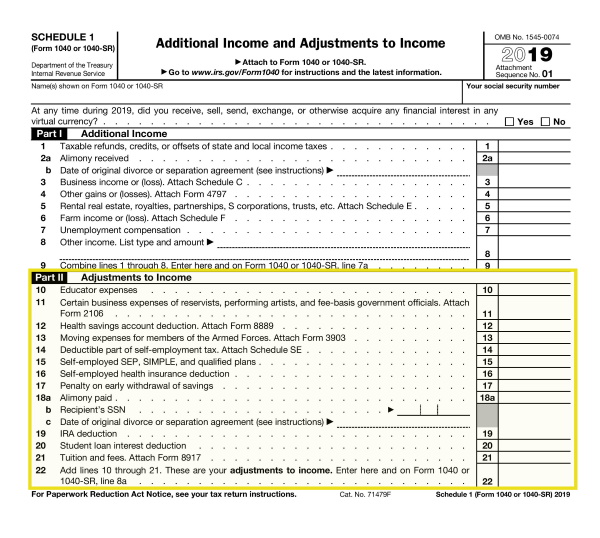

Before the Tax Cuts and Jobs Act, the majority of taxpayers already opted to take the standard deduction rather than itemize, and now an even larger percentage do so. These taxpayers can still take advantage of a set of deductions that don’t require itemizing and were unaffected by the TCJA. These deductions (nicknamed “above-the-line” deductions because they are taken before adjusted gross income (AGI) is calculated), have their new home on the 2019 Form 1040 Schedule 1.

Line 10 Educator expenses:

Eligible grades K-12 teachers can deduct up to $250 (for 2019) in qualified unreimbursed classroom expenses, per spouse if you are both teachers. Save your receipts.

Line 11 Certain business expenses:

This deduction only applies to military reservist for costs traveling more than 100 miles from home for duty, performing artists, and fee-basis government officials. Consult a tax professional. You will also need to attach Form 2106.

Line 12 Health savings account deduction:

HSA contributions are noted here. You’ll also need to attach Form 8889, which will detail both your contributions and distributions for the year.

Line 13 Moving expenses for members of the armed forces:

The TCJA restricted this deduction to active duty members of the armed forces moving on orders. You will need to attach Form 3903 detailing eligible costs.

Line 14 Deductible part of self-employment tax:

If you had side income, you likely had to pay self-employment taxes and are already attaching Schedule SE. You can deduct half of those taxes here.

Line 15 Self-employed SEP, SIMPLE, and qualified plans:

If you contributed to a self-employment retirement plan, deduct that amount here.

Line 16 Self-employment health insurance deduction:

Self-paid insurance premiums are deductible here. See the Form 1040 Schedule 1 instructions.

Line 17 Penalty on early withdrawal of savings:

If you cashed out a CD or other savings account early, you can write off any early-withdrawal penalty fee listed on your Form-INT or Form-OID here.

Line 18 Alimony paid:

The TCJA changed the tax treatment of alimony beginning January 1, 2019, hence the reason for the date of the agreement in 18c. If your divorce or separation agreement was before this date, you can deduct your payments here, and they want your ex-spouse’s SSN so the IRS can verify it’s included in their taxable income on their return.

Line 19 IRA deduction:

If you have a traditional IRA, some or all of your contributions may be deductible. There are a number of variables, so consult your tax professional or use the worksheets available in the Form 1040 Schedule 1 instructions.

Line 20 Student loan interest deduction:

You can deduct up to $2,500 in interest paid on your qualified student loans here. To be eligible, you cannot be filing married filing separately, your AGI must be less than $85,000/single or $170,000 married filing jointly, and you or your spouse can’t be claimed as a dependent on anyone else’s return.

Line 21 Tuition and fees:

This deduction expired at the end of 2017 and was retroactively renewed in December of 2019. You can deduct up to $4,000 in qualified education expenses and will need to attach Form 8917. If you would have qualified for the deduction in 2018, look into filing an amended return.

Line 22 Add lines 10 through 21 (and any other adjustments to income)

The sum of your deductions here transfers to line 8a of your Form 1040. Ten uncommon deductions that can also be added here are listed in the instructions. Most are relatively obscure, but take a glance and make sure you don’t miss any that apply to your tax circumstances (they include the Archer MSA, nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money, attorney fees paid in connection with an award from the IRS, etc).

Consult with your Bacon & Gendreau tax professional and make sure you are getting every deduction that you deserve.