The IRS and the Treasury Department launched their new web tool today allowing taxpayers to submit their direct deposit banking information and check on the current status of their economic impact payment. The tool is available for taxpayers who have filed a return in 2018 and/or 2019 and is separate from the tool for non-filers.

The new Get My Payment tool will provide you with:

The current status of your payment, including the bank name and last four digits of the account number on file or if you can expect to receive a check, and the scheduled date of your deposit or mailing.

The option to submit your bank or financial account information, only if your payment has not already been scheduled for delivery.

To help protect against fraud, the tool does not allow people to change bank account information already on file with the IRS.

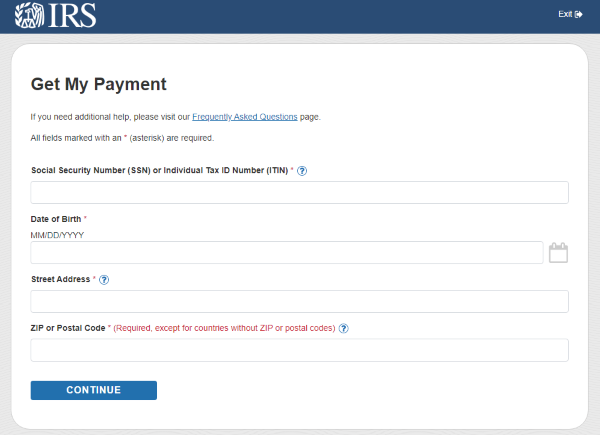

You will be asked for your:

Social Security NumberDate of birthStreet addressZip code

These must match the information the IRS has from your last filed return.

To add a bank account, you will also need your:

Adjusted Gross Income from your most recently filed return, either 2018 or 2019The refund amount or amount owed on that returnBank account type, routing, and account numbers

A letter from the IRS will be mailed to your last known address 15 days after your payment is paid, detailing how the payment was made and providing instructions on how to report any issues in receiving it.

Large numbers of payments have already been made over the past several days. Those with banking info on file with the IRS may have already seen payments processing in their accounts. Those receiving Social Security retirement or disability benefits and Railroad Retirement benefits should automatically be receiving theirs soon as well, in the same manner as they normally receive their benefits.