Tax season is stressful enough. With all the complications the continuing pandemic and its relief packages have caused, many taxpayers are going to be caught off guard when it comes time to file their returns. Are you going to be prepared? Start planning now and breeze through the 2022 tax season.

1. Get organized and begin gathering missing records.

Get a manila envelope or folder and start filling it with the tax records your already have. Receipts for charitable donations, medical expenses, home improvements, property tax bills, gambling wins and losses, etc. should be collected throughout the year.

When January rolls around you can add the other tax documents as they come and be ready for your tax return preparation appointment. New forms you may be receiving early in 2022 include IRS Letter 6419, noting the amount of any advance Child Tax Credits you received, or IRS Notice 1444-C, noting any spring 2021 Economic Impact Payment.

If you’ve moved or changed jobs during the year, confirm that each 2020 employer and financial institution has your current mailing address and email to avoid delayed or lost tax forms.

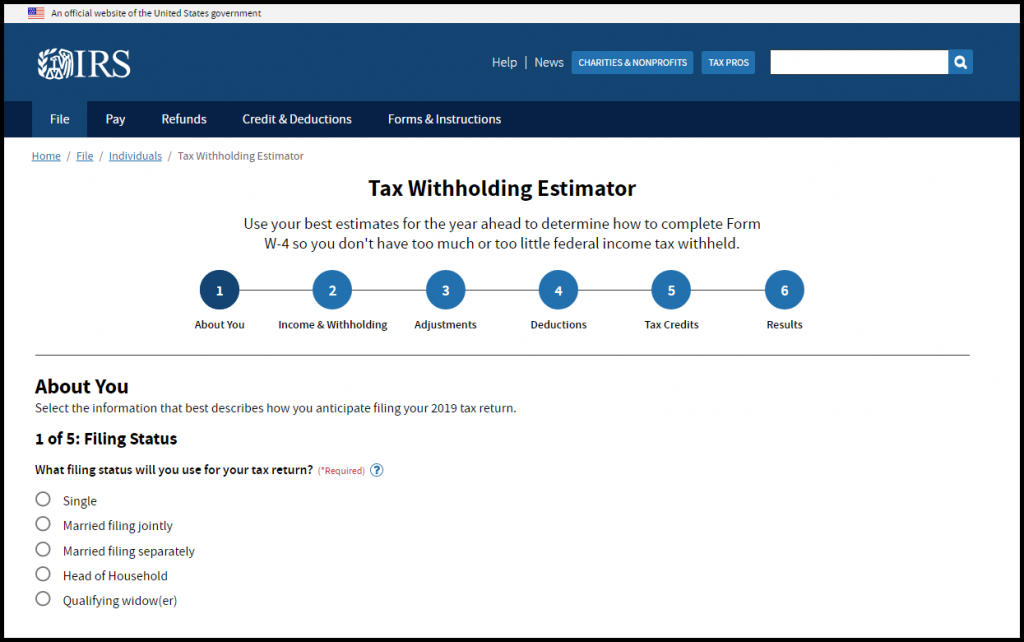

2. Check your withholding and make any adjustments asap.

There are just a few more paychecks this year, and the window to avoid an unpleasant surprise when you file your return is closing. If you didn’t recalculate your withholding earlier this year, were furloughed or unemployed at any point, or owed an unexpectedly large amount last year, do it today. Most taxpayers can use the Tax Withholding Estimator provided by the IRS. If you are self-employed, have multiple jobs, or large investments you may be required to make estimated tax payments and should seek professional help.

3. If you don’t already have one, start shopping for a tax preparer.

When you choose a professional firm like Bacon & Gendreau, your dedicated tax professional will have decades of experience and continuing education to help you make the best possible decisions to minimize your tax liability, during your tax return session and beyond. They will be there year-round to answer your questions and stand behind your return.

Once you’ve chosen a preparer, schedule your appointment with them as soon as you have your documents in hand after the new year. If you wait until late March or April, you may be unable to get an appointment before the filing deadline.

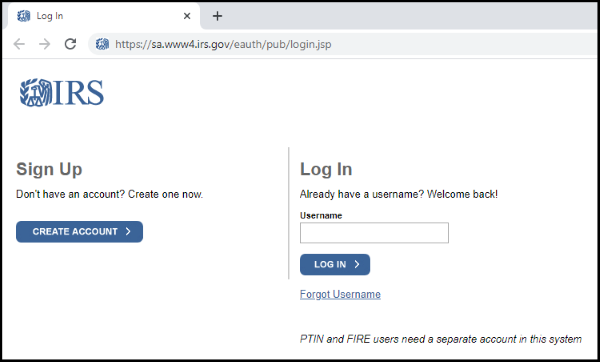

4. Register for an IRS Online Services Account and an Identity Protection PIN.

If you don’t already have one, sign up for an IRS Online Services Account. For most taxpayers the verification process should only take a few minutes. The secure account will allow you quick access to various IRS services without the need for long wait times over the phone. You will be able to view any amounts owed and request a payment plan, view your payment history or scheduled payments, access your tax transcripts, get digital copies of select IRS notices, verify your Economic Impact Payment amounts, and respond to authorization requests from tax professionals.

Your account also gives you the ability to request an Identity Protection PIN. An IP PIN is a six-digit number that prevents someone else from filing a tax return using your Social Security number. After signing up, you will be issued a new PIN each January by mail to be used on any federal returns submitted that calendar year. You can also retrieve your annual PIN after mid-January each year from your IRS Online Services Account. You will need to provide this PIN to your trusted tax preparer. We strongly encourage you to take this extra step to secure your SSN against fraudulent federal returns.

5. Ensure you are covered for taxes on any side gigs or unemployment payments.

Income you made from a side hustle and any unemployment payments you received are taxable. If you were not making estimated payments or having taxes withheld, depending on the amount you owe you could face penalties and interest at filing time. To avoid this, make any required payments by January 15, 2022. If you are unsure, don’t wait until filing season; consult a tax professional now.

6. If you’ve had a big life event this year, reassess your overall tax picture.

If you had a big life event or a change to your eligible filing status, or will by December 31st, your tax liability could be drastically different than previous years. If you’ve married, divorced, have a new child or an older child is no longer a dependent, bought or sold a home, had a significant raise or pay cut, or you or your spouse started a new job, you should review your withholding and tax deferred savings as soon as possible.

If any of these events resulted in an address or name change, be sure to notify the IRS or Social Security Administration respectively as soon as possible. A mismatch will delay the processing of your return.

7. Use the money in your Flexible Spending Account.

If you have been putting money in a tax-free FSA account, use it so you don’t lose it. Check with your employer as some plans allow you to carry over $500 to the next year, and some give you until the middle of March to use last year’s funds. If your FSA plan requires you to use the money by December 31st, schedule that root canal you’ve been putting off or replace that expired first aid kit.

8. Take advantage of the new charitable deduction.

Normally, taxpayers need to itemize their deductions in order to receive a tax benefit from charitable contributions. The CARES Act created a temporary deduction for cash contributions available to those who don’t itemize, and it was expanded and extended through 2021. It is worth up to $300 for single filers and up to $600 for married filing joint taxpayers.

9. Fund your tax-deferred accounts.

Have you made the maximum contribution to your Health Savings Account? Are you contributing the allowable maximum to your 401(k) or IRA? Consider saving more if your budget allows. All those contributions work towards a healthy savings and can have significant tax advantages. Seek professional advice on the best options for you.

10. Estimate your 2021 and 2022 income to decide if bunching deductible expenses will benefit you.

In order to deduct certain expenses, their sum will need to be greater than the standard deduction. For the 2021 tax year, the standard deduction is $12,550 for single taxpayers and $25,100 for married taxpayers filing jointly. For medical expenses, only the portion over 7.5% of a taxpayer’s adjusted gross income counts towards that figure. Maybe you should have that medical or dental procedure you’ve been putting off before December 31st or make that big annual charitable donation in January instead of at Christmas. Perhaps it’s more advantageous for you to upgrade your business’ equipment after the first of the year instead of before. By consciously bunching deductible expenses into a certain tax year, you can maximize your deduction and minimize your tax liability. Your tax professional can advise you for your individual tax situation.

11. Estimate the tax consequences before deciding to sell major assets.

If you want to take advantage of the current skyrocketing property values but you’ve lived in your home less than 2 years, selling could cost you big at tax time. If you sell an investment you’ve held for under a year at a profit, you’re going to pay significantly more tax than if you hang on to it a little longer. If your investments underperformed this year, you might decide to offload some and use the losses to reduce your ordinary income. Work with a financial advisor or tax professional so you understand the pros and cons before selling major assets.

12. Familiarize yourself with the major tax changes likely to affect you.

Stay informed. The negotiations for the Build Back Better plan and the tax provisions it contains are still a work in progress and changing almost daily. Watch our Facebook page and the Bacon & Gendreau blog for news likely to affect your tax return. As always, if you are a client with questions please feel free to contact our office at 860-216-2195 or email your Bacon & Gendreau tax professional.