An IRS Identity Protection PIN (IP PIN) is a six-digit number that prevents someone else from filing a tax return using your Social Security number. It is available to all taxpayers who can provide verification of their identity. When you opt-in, you will be issued a new IP PIN annually. The IP PIN is known only to you and the IRS and helps verify your identity when you file your tax return. We encourage you to take this extra step to secure your SSN against fraudulent federal returns.

After signing up for an IP PIN, you will be issued a new IP PIN each January to be used on any federal returns submitted that calendar year. You will need to provide this IP PIN to your trusted tax preparer. The IRS will never ask you for your IP PIN for other purposes. Its only use is to verify filed returns. Phone calls, emails, or texts asking for your IP PIN are scams.

Sign up for an IRS Online Account

To opt-in to the program, you will first need an IRS Online Account. This account provides access to all the IRS online services available to individual taxpayers, including viewing your balance, making payments or creating payment plans, accessing your tax records or requesting tax transcripts, and updating your information on the Child Tax Credit Portal.

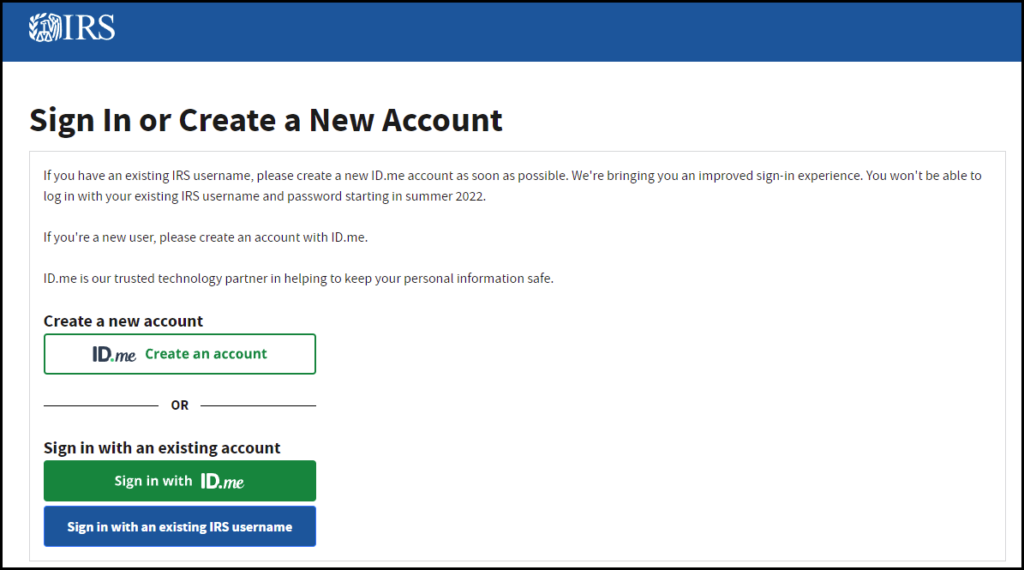

Update 2/21/22: The IRS recently implemented new requirements to verify your identity through a third-party called ID.me when signing up for an account, but after numerous problems and outcry over privacy concerns they have walked backed some of the changes while they work towards an alternative system.

For the rest of the 2021 tax season, if you already have an IRS account you can continue to use your current login information. If you need to create an account you now have two options with the third-party servicer ID.me: authentic your identity with biometric data including facial recognition, or with no biometric data during a live, virtual interview with agents. Wait times for an agent to solve issues before the change could be hours long, and it remains to be seen if this issue will persist.

All biometric data used is scheduled to be deleted over the next few weeks. This is a short-term solution until partners across the government can roll out a new Login.gov authentication tool from the General Services Administration.

To create an account during the 2021 tax season you will need:

- An email address

- Your Social Security Number or ITIN

- A photo of your license or state ID OR your passport OR your passport card

- A mobile device that can take a selfie or a computer connected to a web cam

If your documents cannot be digitally verified, you may be asked to enter a secure video call with a representative from ID.me to complete the process.

If you do not wish to have these documents digitally verified with facial recognition, you may request to skip this step and go directly to verifying your original documents with a live representative.

Request a PIN

Go to the IRS Get An Identity Protection PIN page. Sign in to your IRS account and use the portal to request your IP PIN. You only need to enroll once and you will be issued a new IP PIN each year. Your IP PIN should come in the mail in January as IRS Notice CP01A. You can also retrieve your annual PIN after mid-January each year from your IRS Online Account.

Using your IP PIN

Once a taxpayer signs up for an IP PIN, they will need to provide it annually to their trusted tax preparer. This includes spouses and any dependents listed who are signed up for the program. An e-filed return will be rejected if any of the SSN on it are associated with an IP PIN that was not provided. Not all individuals on any given return are required to sign up for an IP PIN, and only those that have one need provide it.